ABC Self Assessment Tax for Mac. ABC Self Assessment prides itself on being simple-to-use software, allowing people to submit their personal or partnership tax return. It is ideal for people who haven’t the first clue when it comes t. Download LaTeXiT 2.8.1 for Mac. Fast downloads of the latest free software! Sage Business Cloud Accounting. A wise choice for those seeking an all-encompassing finance. Showing an air of confidence without being cocky is a strength man- agers seek in artists they sign, and that kind of self. ABC News, 2004, “Pop Stars.

Click the link below to download Enigmo 2 for MacOS. The game will run in a Demo mode unless you have a serial # to activate the full version. Otherwise, you can buy the full version on the Mac App Store. CLICK HERE TO DOWNLOAD ENIGMO 2. MORE GAME FILES. Enigmo 2. The Ultimate Puzzle Game Just Entered A New Dimension. Click here for the Windows/PC version.

Andica Self Assessment Software Overview

Andica Self Assessment Software (for Individual tax payers)

Andica Self Assessment tax software for Personal tax returns can be used by Individual tax payers or Professionals. The software is supplied in two editions:

Abc Self Assessment Tax For Mac 2019

Andica Self Assessment Personal edition that provides HMRC (Inland Revenue) self assessment tax return solution suitable for use by individual taxpayers. This edition is available in two options, 1 tax payer edition to prepare tax returns for 1 taxpayer or a 5 tax-payers edition suitable for up to 5 tax returns prepared from a single installation.

Andica Self Assessment Software Professional edition is suitable for accountants, tax consultants or other professionals preparing self assessment tax returns for their clients. The software is available in bands of tax payers to suit the size of your client base.

If you are an employee claiming expenses and benefits in kind, self-employed, a company director, Lloyd's underwriter, Minister of Religion, partner in a business, trustee, an employee or a pensioner paying higher rate of tax or with more complex tax affairs, you are very likely required to complete HMRC (Inland Revenue) Self Assessment tax return forms SA100, calculate taxes due and file the returns on time. Depending on the type of income, you may also be required to include other supplementary pages with your tax returns, the software includes all supplementary forms as listed on the features page.

Tax is taxing, unless that is you are using Andica Self Assessment tax return software designed to simplify the preparation and completion of tax return forms with wizard style entry forms and tax calculations. Returns can be submitted electronically using the File by Internet feature.

Andica Self Assessment tax returns software comes in two versions:

Andica Self Assessment Personal

Abc Self Assessment Tax For Mac 2020

A self assessment tax return solution suitable for use by individual taxpayers. The software helps you simplify and manage your tax returns preparation, calculations of tax and online submission of returns to HMRC. This edition is available in two options, 1 tax-payer edition to prepare tax returns for 1 taxpayer or a 5 tax-payers edition suitable for preparation of up to 5 tax returns from a single installation.

Andica Self Assessment Professional

Abc Self Assessment Tax For Mac Address

A self-assessment tax return solution suitable for use by accountants, tax consultants or book-keepers to prepare self assessment tax returns for their clients. The software is available with multiple tax payers returns and optional multi user feature.

Abc Self Assessment Tax For Mac Download

Windows 10 update edge chromium. Andica Self Assessment software is a time saving and cost effective solution with data entry screens that replicate HMRC tax forms therefore simplifying the process of recording tax returns information. Based on data processed, the software will calculate and provide a report showing total tax for the year and amount of tax liability or refund due.

The software supports HMRC online filing of Tax Returns which should be submitted by 31st January following the end of the tax year. If tax returns are not submitted by the deadline, HM Revenue & Customs (HMRC) will impose penalties for late submission of returns.

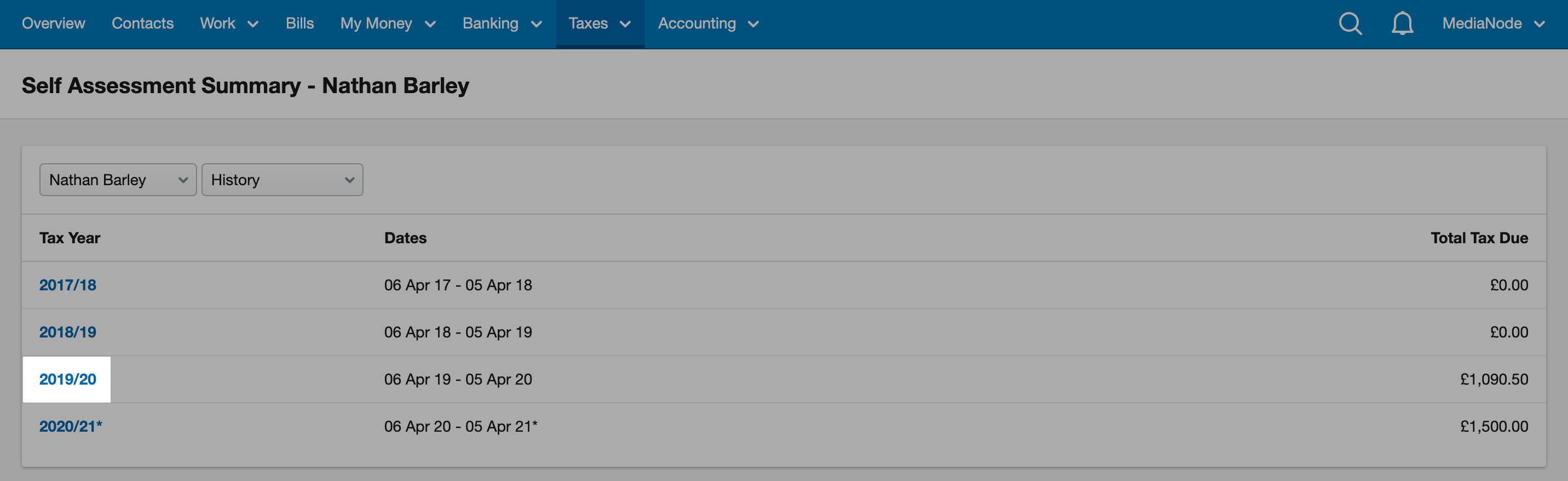

Last updated: 19 Mar, 2020 What are APIs?HMRC have provided a method of obtaining information relevant to the completion of a Tax Return called Application Program Interfaces or APIs. This is the first part of their overall Digital transformation project known as Making Tax Digital. Not a practice?The following article relates to users of the practice software. If you are an individual please click here for help on using the APIs. What data can be requested from HMRC for Self assessments?This article will help you to use the HMRC APIs to obtain self assessment information direct from HMRC. Please click here to find out what information you will receive from HMRC. Prerequisites for using the Self assessment APIsThe following details must be completed to ensure that information can be obtained from HMRC for Tax Returns:

Step 1 - Authorising TaxCalc to talk to HMRCThe first step is to authorise TaxCalc software. This is a process that effectively links TaxCalc (with you as an agent) to HMRC. Please follow the steps below to authorise the software:

Step 2: Fetching information from HMRCOnce you have authorised TaxCalc then click on the Fetch button following the successful authorisation of TaxCalc. The following screen will be displayed: The data TaxCalc has retrieved from HMRC will be displayed in each of the relevant areas. The list on the left hand side will be displayed in bold where data is present. TaxCalc's stepped process will guide you through each of the screens displaying a summary of the data on the final screen: Click on the Fetch button to have the data shown within the Tax Return. Data within the Tax Return can be identified by the box being shown in green with the HMRC logo alongside it. What do I do if the data received from HMRC is incorrect?It is recommended that you check the data being received from HMRC against documentation provided to you by your client before submitting the Tax Return to HMRC. If you consider the data to be incorrect then you can either:

Understanding error messagesBelow is a list of the most common errors you may encounter while using the APIs:

| ||||||||||