- If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259. Part A hospital inpatient deductible and coinsurance. You pay: $1,484 deductible for each benefit period. Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $371 coinsurance per day of each benefit period.

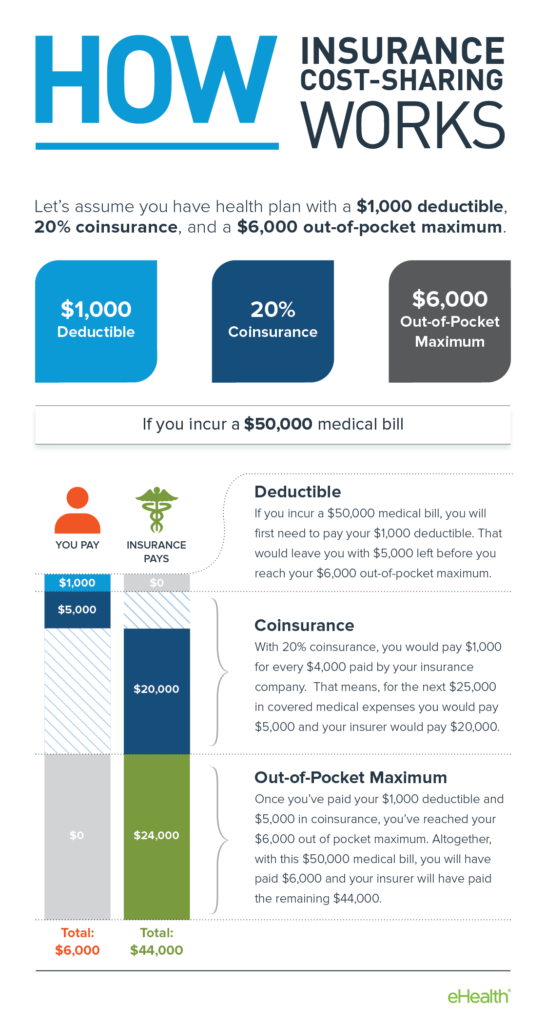

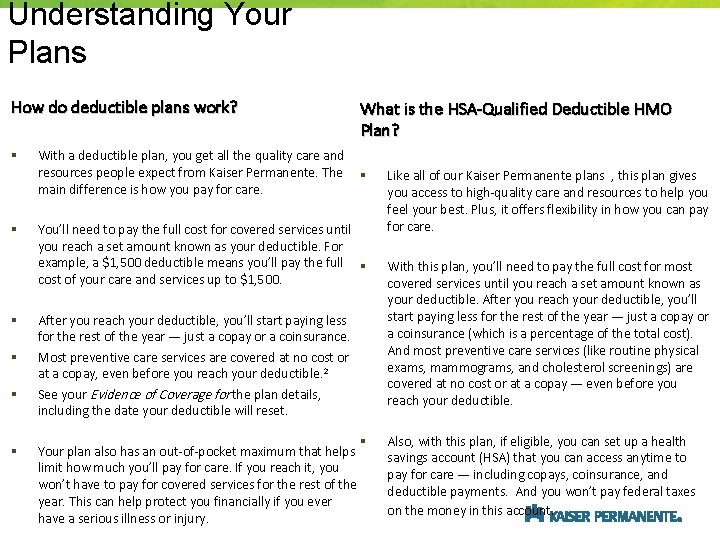

- Coinsurance refers to the percentage of treatment costs that you have to bear after paying the deductibles. This amount is generally offered as a fixed percentage. It is similar to the copayment provision under health insurance.

Health insurance rarely covers 100% of your healthcare costs. The costs that are not covered are called out-of-pocket expenses for the patient. These are of two types — copayand coinsurance. This comparison explains the difference between the two, as well as related terms deductibleand out-of-pocket maximum. Mac os x sierra dmg direct download. For the physicians group $210 is the deductible, $16.06 is the coinsurance, and $64.28 is paid by the plan. So I’m still scratching my head about the $300 copay I had to pay before being given the privilege to pay my deductible then coinsurance. All in all I pay $666.06.

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met.

A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin to pay.

Understanding Medicare Copayments & Coinsurance

Medicare copayments and coinsurance can be broken down by each part of Original Medicare (Part A and Part B). All costs and figures listed below are for 2021.

Medicare Part A

After meeting a deductible of $1,484, Medicare Part A beneficiaries can expect to pay coinsurance for each day of an inpatient stay in a hospital, mental health facility or skilled nursing facility. Even though it's called coinsurance, it operates like a copay.

- For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance

- Days 61 to 90 require a coinsurance of $371 per day

- Days 91 and beyond come with a $742 per day coinsurance for a total of 60 “lifetime reserve' days

These lifetime reserve days do not reset after the benefit period ends. Once the 60 lifetime reserve days are exhausted, the patient is then responsible for all costs.

For a stay at a skilled nursing facility, the first 20 days do not require a Medicare copay. From day 21 to day 100, a coinsurance of $185.50 is required for each day. Beyond 100 days, the patient is then responsible for all costs.

Under hospice care, you may be required to make copayments of no more than $5 for drugs and other products related to pain relief and symptom control, as well as a 5% coinsurance payment for respite care.

Under Part A of Medicare, a 20% coinsurance may also apply to durable medical equipment utilized for home health care.

Medicare Part B

Once the Medicare Part B deductible is met, you may be responsible for 20% of the Medicare-approved amount for most covered services. The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare.

Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

Understanding Medicare Deductibles

Medicare Part A and Medicare Part B each have their own deductibles and their own rules for how they function.

Medicare Part A

The Medicare Part A deductible in 2021 is $1,484 per benefit period. You must meet this deductible before Medicare pays for any Part A services in each benefit period.

Medicare Part A benefit periods are based on how long you've been discharged from the hospital. A benefit period begins the day you are admitted to a hospital or skilled nursing facility for an inpatient stay, and it ends once you have been out of the facility for 60 consecutive days. If you were to be readmitted after 60 days of being home, a new benefit period would start, and you would be responsible for meeting the entire deductible again.

Medicare Part B

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services.

Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

Cover your Medicare out-of-pocket costs

There is one way that many Medicare enrollees get help covering their Medicare out-of-pocket costs.

Medigap insurance plans are a form of private health insurance that help supplement your Original Medicare coverage. You pay a premium to a private insurance company for enrollment in a Medigap plan, and the Medigap insurance helps pay for certain Medicare out-of-pocket costs including certain deductibles, copayments and coinsurance.

The chart below shows which Medigap plans cover certain Medicare costs including the ones previously discussed.

Click here to view enlarged chartScroll to the right to continue reading the chart

Medicare Supplement Benefits

Part A coinsurance and hospital coverage

Part B coinsurance or copayment

Part A hospice care coinsurance or copayment

First 3 pints of blood

Skilled nursing facility coinsurance

Part A deductible

Part B deductible

Part B excess charges

Foreign travel emergency

| A | B | C* | D | F1* | G1 | K2 | L3 | M | N4 |

|---|---|---|---|---|---|---|---|---|---|

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | 50% | |||||||

| 80% | 80% | 80% | 80% | 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

+ Read more1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

3 Plan L has an out-of-pocket yearly limit of $3,110 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission.

- Read lessIf you're ready to get help paying for Medicare out-of-pocket costs, you can apply for a Medigap policy today.

Find Medigap plans in your area.

Find a plan

Find a planResource Center

Enter your email address and get a free guide to Medicare and Medicare Supplement Insurance.

By clicking 'Sign up now' you are agreeing to receive emails from MedicareSupplement.com.

We've been helping people find their perfect Medicare plan for over 10 years.

Ready to find your plan?

What is Copay?

A copay or copayment is the amount of money you are required to pay directly to the healthcare provider (doctor, hospital etc.) per visit, or to a pharmacy for every prescription filled.

Copays discourage unnecessary visits by making the patient responsible for a small portion of her healthcare costs. Copays are typically $15 to $50 per visit but may vary depending upon the following factors:

- Specialists vs. General Physicians: Copays for specialist visits are usually higher than for general physicians.

- Generics vs. brand name drugs: Copays for prescription drugs are around $5 to $20 per prescription, with lower copays for generics vs. brand name drugs. This provides an incentive to lower costs by using drugs that are chemically equivalent but cheaper.

- In-network vs. Out-of-network: Insurance companies contract with healthcare providers to agree upon reimbursement rates. When you see a provider 'in-network' — i.e., a provider that the insurance company has an agreement with — you may pay a lower copay than when you see a doctor out-of-network.

Copays are applicable until the annual out-of-pocket maximum is reached but many insurance plans waive copays for preventive care visits like annual physicals or child wellness checkups.

High-deductible health plans (HDHP) usually do not have a copay.

What is Coinsurance?

The copay is usually too small to cover all of the provider's fees. The provider collects the copay from the patient at the time of service and bills the insurance company. If the provider is in-network, the insurance company first lowers the 'allowed amount' to the pre-negotiated rate for that service (more about this in the example below). If the deductible has been met, the insurance plan then covers a large percentage (usually 60-90%, depending upon the plan) of the allowed amount. The patient is responsible for the balance (10-40% of the allowed amount). This balance is called coinsurance.

Coinsurance may be higher when you see an out-of-network provider, but stays the same whether you see a GP or a specialist.

What is a Deductible?

The annual deductible specified in your plan is the total coinsurance you must pay in a calendar year before the insurance company starts paying for any healthcare costs.

Do copays count toward the deductible?

No, copays do not count toward the deductible. However, copays do count toward the annual out-of-pocket maximum, which is the total amount you are liable to pay for all your healthcare costs in any given year — including copay and coinsurance.

This video explains deductibles, coinsurance and copay:

Copay, Coinsurance and Deductible Example

Assume that a plan has a deductible of $1,000, $30 copay and 20% coinsurance.

The patient makes her first visit to a doctor in that year. Like every visit, she pays a copay of $30 at the time of the visit. Suppose the total bill for that visit is $700. Virtualbox macos guest. The doctor is in the plan's network so the insurance company gets a discounted rate of $630 for that visit. After subtracting the $30 copay from the patient, the balance owed to the doctor is $600.

If the deductible had been met, the insurance company would have paid 80% of this $600 balance. However, since the deductible has not been met yet, the patient is responsible for the full $600.

The second visit is similar. The doctor's $500 bill is discounted down to $430 because of the preferred rate that the insurance company gets. The patient pays a $30 copay and so the balance is $400. Since the $1,000 deductible has not been met yet, the patient is responsible for this $400 too.

But the $600 from the first visit and the $400 from the second visit total $1,000 and serve to meet the deductible. So for the third visit, the insurance plan steps up and starts paying for healthcare costs.

In our example, the doctor's bill for the third visit is $600, discounted to $530. The patient still pays a $30 copay even after the deductible is met. For the $500 balance, the plans pays 80%, or $400 and the patient is responsible for 20%, or $100.

Copay And Coinsurance And Billing Insurance

Other considerations

Rdp connection on mac free. Navigating the health insurance maze can be challenging because there are other variables involved. For example,

- Some plans have different deductibles for in-network and out-of-network providers.

- Some plans do count copay amounts towards the deductible; most don't.

- Not all plans have an out-of-pocket maximum. For plans that do, you do not have to pay any more copay or coinsurance once you reach that limit in total out-of-pocket expenses for the year, .

- Some plans have a lifetime maximum so the insurance company stops paying for healthcare if they have already paid out that amount over the lifetime of the patient.

- Preventive care such as vaccines for children is usually covered 100%. Copays are waived and deductibles do not apply in such cases.

- Even with a deductible, it is often advantageous to have insurance because of the fee discount negotiated by an insurer with the provider. i.e. the fee that healthcare providers can charge for a particular service is lower if the patient is insured.

Copay And Coinsurance At The Same Time

References